Project Background

In the finance industry, the rise of digital transactions has brought about unprecedented convenience for consumers and businesses alike. However, this convenience has also opened the floodgates for fraudulent activities. Financial institutions face a daunting challenge: how to effectively detect and prevent fraudulent transactions while minimizing the impact on legitimate customers. The problems associated with fraudulent transactions are multifaceted, including slow detection times, high false-positive rates, and the evolving tactics employed by fraudsters. As financial institutions strive to protect their assets and maintain customer trust, the need for advanced solutions has never been more pressing.

Problems Faced by the Client

The consequences of fraudulent transactions extend beyond financial losses; they can severely impact customer experience and trust. Financial institutions often grapple with slow detection times, which can lead to significant monetary losses before any action is taken. Moreover, high false-positive rates can frustrate legitimate customers, leading to unnecessary transaction declines and a poor user experience. For instance, a customer attempting to make a legitimate purchase may find their transaction flagged as suspicious, resulting in inconvenience and dissatisfaction. This not only affects customer retention but can also tarnish the institution's reputation in a highly competitive market.

Solutions Using Artificial Intelligence Based Algorithms

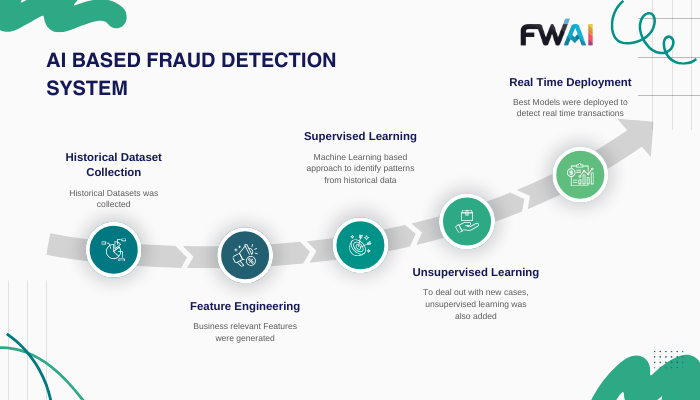

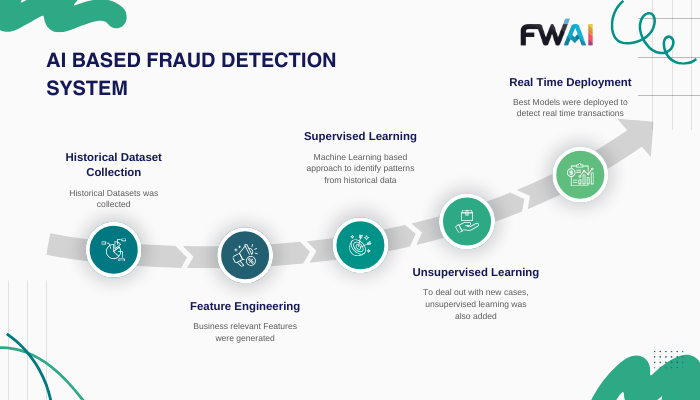

To address these challenges, we implemented a comprehensive solution leveraging machine learning algorithms. Our approach involved developing a robust fraud detection system that utilizes supervised and unsupervised learning techniques to analyze transaction data in real-time.

1. By employing supervised learning algorithms such as Random Forest and Gradient Boosting, we trained our model on historical transaction data to identify patterns indicative of fraudulent behavior. This allowed for real-time detection of anomalies, significantly reducing detection times.

2. To tackle the issue of high false-positive rates, we integrated unsupervised learning techniques, such as clustering algorithms, to segment transactions based on behavioral patterns. This enabled the model to differentiate between legitimate and fraudulent transactions more accurately, thereby minimizing unnecessary declines.

3. Our solution also incorporated adaptive learning mechanisms, allowing the model to continuously learn from new data and evolving fraud tactics. This ensures that the system remains effective against emerging threats, providing a dynamic defense against fraud.

Key Benefits to Users

The implementation of our machine learning-based fraud detection system yielded significant benefits for our client in the finance industry:

1. The real-time detection capabilities drastically reduced the time taken to identify fraudulent transactions, allowing for immediate action and minimizing potential losses.

2. By reducing false-positive rates, legitimate transactions were less likely to be flagged as suspicious. This led to a smoother customer experience, fostering trust and loyalty among users.

3. The financial institution experienced a marked decrease in losses due to fraud, translating into substantial cost savings. Additionally, the reduction in customer service inquiries related to false declines further optimized operational efficiency.

4. The machine learning model is designed to scale with the institution’s growth, accommodating increasing transaction volumes without compromising performance.

Future Works

As the landscape of financial fraud continues to evolve, our commitment to innovation remains steadfast. Future work in this direction will focus on several key areas:

1. We plan to incorporate advanced analytics techniques, such as natural language processing (NLP), to analyze unstructured data from customer interactions and social media. This will provide deeper insights into customer behavior and potential fraud indicators.

2. We aim to establish partnerships with other financial institutions to share anonymized data and insights. This collaborative approach will enhance the overall effectiveness of fraud detection systems across the industry.

3. We recognize the importance of educating users about fraud prevention. Future initiatives will include developing educational resources and tools to empower customers to recognize and report suspicious activities.

4. We will implement a feedback loop to continuously refine our machine learning models based on new data and emerging fraud trends. This will ensure that our solutions remain at the forefront of fraud detection technology.

To the Horizon

If your financial institution is facing challenges related to fraudulent transactions, slow detection times, or high false-positive rates, we invite you to explore our machine learning solutions. Our team of experts is dedicated to helping you safeguard your assets while enhancing customer experience. Contact us today to discuss how we can tailor a solution to meet your specific needs and stay ahead of the ever-evolving landscape of financial fraud. Together, we can build a more secure future for your institution and your customers.